Indian banking system meaning

What is banking system:-

A banking system is a collection of institutions that provide financial services to us. These organizations are responsible for running the payment system, making loans, accepting deposits and facilitating investments. The banking industry is one of the most essential financial pillars of the financial sector, and is vital to the functioning of the economy.

It is important for the economic development of a country that its trade, industrial and agricultural financing needs are handled with greater commitment and responsibility. Consequently, the progress of a country is inextricably linked with the development of banking. In today’s economy, banks should be viewed as growth leaders rather than money merchants. They play an important role in deposit collection and credit disbursement in many sectors of the economy.

The Reserve Bank of India (RBI), commercial banks, co-operative banks and development banks comprise the banking system (development finance institutions) of India.These institutions are the core of India’s financial system, acting as a meeting point for savers and investors. Banks play a vital role in the development of poor countries by mobilizing resources and allocating them efficiently.

The features of the Indian banking system:

Dealing with Money

A bank’s main characteristic is that it handles all financial transactions. You can put your money in a bank account, for example, to store it safely, and you’ll earn interest on the money saved in the account.

Provides Loans

Banks obtain additional funds by providing loans for a wide variety of products. The bank earns extra money by lending money to eligible individuals at pre-determined rates.

Banks now offer loans for various purposes, including study loans, vehicle loans, housing loans, personal loans, etc.

Withdrawal and payment facilities

Customers can use the bank’s multiple payment and withdrawal services to receive their money quickly and conveniently. Customers can use checks and drafts to withdraw money, as well as ATMs set up by banks at various sites throughout the city.

Internet services

Customers can make use of the bank’s multiple payment and withdrawal services to receive their money quickly and conveniently. Customers can use checks and drafts to withdraw money, as well as ATMs set up by banks at various sites throughout the city.

Business

The sole purpose of banking is not to supply banking services to the consumers. To earn extra money, all banks are involved in subsidiary enterprises. Their sole responsibility is to provide maximum customer satisfaction and maximum interest rates to attract more and more customers to the bank. Money is moved from one hand to another in order to make a profit.

The importance of banking system in India

Inadequate capital formation makes economic development difficult in a country. Commercial banks are currently encouraging people to save their money and mobilize it for beneficial use.

Credit creation boosts production, spurs economic growth and, in turn, creates a large number of job opportunities.

Commercial banks promote balanced regional development in India by providing necessary financial infrastructure and funds to backward regions.

Commercial banks help in the promotion of the primary sector by providing timely credit to agricultural farmers.

They provide advanced loans to consumers for the purchase of assets such as housing, consumer goods and furniture, among other things, and they encourage people to live a higher standard of living.

The banking sector plays an important role in the Indian economy, as commercial banks support the Indian government in achieving each of the planned economic development goals of the country.

For both internal and external trade, commercial banks provide the necessary financial support and infrastructure.

Banking in India began in the first decade of the 18th century with the coming into existence of the General Bank of India in 1786. After this came Bank of Hindustan. Both these banks are now closed. The oldest bank in existence in India is the State Bank of India which was established in Calcutta in June 1806 as “The Bank of Bengal”. A few decades later, foreign banks such as the Crédit Lyonnais began Calcutta operations in the 1850s.At that time, Calcutta was the most active trading port, mainly due to the trade of the British Empire and due to which banking activity took root and flourished there. The first wholly Indian-owned bank was the Allahabad Bank, established in 1865.

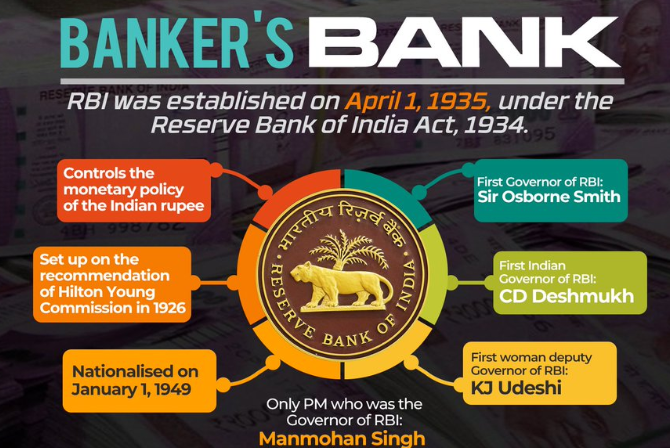

By the 1900s, the market expanded with the establishment of banks such as the Punjab National Bank in Lahore in 1895 and the Bank of India in Mumbai in 1906, both of which were established under private ownership. The Reserve Bank of India formally took over the responsibility of regulating the Indian banking sector from 1935. After India’s independence in 1947, the Reserve Bank was nationalized and given extensive powers.

Definition

Bank:- Financial institution whose primary activity is to act as a payment agent for customers and to borrow and lend money, Banks are important players of the market and offer services as loans and funds:

- Banking was originated in 18th century

- First bank were General Bank of India and Bank of Hindustan now defunct

- Punjab National Bank and Bank of India was the only private bank in 1906.

- Allahabad bank first fully India owned bank in 1865

Types of banking

Commercial bank has two meanings:

- Commercial bank is the term used for a normal bank to distinguish it from an investment bank. (After the great depression, the U.S. Congress required that banks only engage in banking activities. whereas investment banks were limited to capital markets activities. This separation is no longer mandatory.)

- Commercial bank can also refer to a bank or a division of a bank that mostly deals with deposits and loans from corporations or large businesses, as opposed to normal individual members of the public (retail banking). It is the most successful department of banking.

- Community development bank are regulated banks that provide financial services and credit to underserved markets or populations.

- Private banks manage the assets of high net worth individuals.

- Offshore banks are banks located in jurisdictions with low taxation and regulation. Many offshore banks are essentially private banks.

- Savings banks accept savings deposits.

- Postal savings banks are savings banks associated with national postal systems

There are some examples of banks in India:-

- Private sector bank

- HDFC, ICICI, Axis bank. Yes bank. Kotak Mahindra bank, Bank of

- Rajasthan Rural bank

- United bank of India. Syndicate bank. National bank for agriculture and rural development (NABARD)

- Commercial bank

- State Bank, Central Bank, Punjab National Bank, HSBC, ICICI , HDFC, etc.

- Retail bank

- BOB, PNB

- Universal bank

- Deutsche bank

Note:- The information provided on this blog is for educational and informational purposes only, does not constitute a suggestion to invest, ask your financial advisor or do your own research before investing in any instrument. Because there is risk involved in the market.